I. WHAT IS DDP?

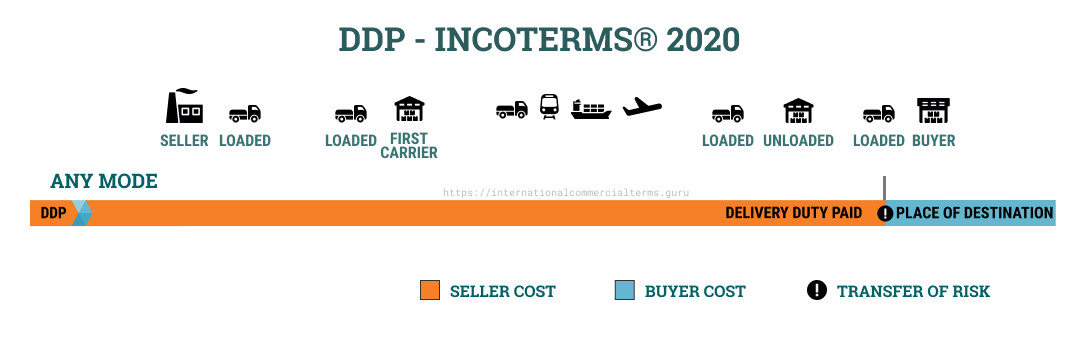

DDP (short for Delivered Duty Paid) is a term in international trade that specifies the obligations, costs, and risks associated with delivering goods from the seller to the buyer under the Incoterms standards published by the International Chamber of Commerce (ICC).

Under DDP terms, the seller is responsible for delivering the goods cleared for import, meaning the seller delivers the goods when they have been cleared for import to the buyer, placed at the buyer's disposal on the arriving means of transport, and ready for unloading at the named place of destination. The seller bears all the risks and costs associated with bringing the goods to the specified place.

DDP can be used for any mode of transport and can also be used when multiple modes of transport are involved.

DDP [Specified Destination] Incoterm® 2020

For instance, the designated delivery location specified by the buyer is at Tien Sa Port, Da Nang, with the address at 01 Yet Kieu, Tho Quang, Son Tra, Da Nang, Vietnam. Under this international trade contract, DDP will be represented as follows: DDP 01 Yet Kieu, Tho Quang, Son Tra, Da Nang, Viet Nam Incoterms 2020.

II. USAGE GUIDELINES

1. Regarding the mode of transport:

This condition will be applicable for all modes of transport and can be used when multiple transport means are involved.

2. Delivery of Goods and Risks (DDP – Delivered Duty Paid):

Delivery cleared for import means the seller delivers the goods when they have been cleared for import to the buyer, placed at the buyer's disposal on the means of transport, and ready for unloading at the specified destination. The seller bears all the risks associated with bringing the goods to the designated place.

The parties involved should clearly define the delivery location. Firstly, this is crucial to mitigate risks of loss or damage to the goods transferred to the buyer at the delivery point. Therefore, it is advisable for both parties to specify the delivery location clearly. Secondly, the seller incurs all the expenses to bring the goods to the delivery point, including import duties. This marks the point where the cost responsibility shifts from the seller to the buyer. Lastly, this location is where the seller must arrange the transportation contract to ensure the goods reach the specified destination. If any issues arise with the goods before they reach the delivery point, all losses will be borne by the seller. For example, the seller will have to bear all additional fees charged by the carrier during transportation. It is recommended that the seller signs the transportation contract to the exact delivery location.

3. Attention for Exporters:

Exporters bear the highest level of responsibility when using the DDP (Delivered Duty Paid) term in buying and selling transactions. They not only have to transport the goods to the designated delivery location but also have to handle customs clearance and pay import duties, VAT, and any other applicable taxes when completing the import procedures, unless otherwise specified by both parties. Exporters should pay attention to point 5 below for consideration on whether to use the DDP term or not.

4. Unloading Costs at the Designated Destination:

If the transportation contract signed by the seller includes unloading costs at the designated destination, the seller is obligated to cover these expenses, unless there is a prior agreement between the parties that the buyer will reimburse these costs.

5. Export/Import Customs Clearance Obligations:

As mentioned in point 3, the DDP term requires the seller to handle export customs clearance and, if necessary, import customs clearance as well. The seller is also responsible for paying any import fees and taxes to complete customs procedures in the importing country. If the seller finds it challenging to organize import customs clearance for the shipment and believes that the buyer is more capable and convenient in handling import customs procedures, the seller should consider using the DAP (Delivered At Place) or DPU (Delivered At Place Unloaded) terms. Under these terms, the seller still has to deliver the goods to the designated delivery location but is not required to handle import customs procedures.

III. RESPONSIBILITIES OF THE BUYER AND SELLER UNDER DPU TERMS

A. RESPONSIBILITIES OF THE SELLER:

A1. General Responsibilities of the Seller

The seller must provide goods and a commercial invoice in compliance with the sales contract and any relevant documents that may be referenced in the contract.

Any documents provided by the seller can be in traditional paper form or electronic form if agreed upon by the parties or customary practice dictates.

A2. Delivery

The seller must deliver the goods by placing them at the disposal of the buyer on the means of transport ready for unloading at the agreed-upon location, if any, at the specified destination, or as already delivered. In both cases, the seller must deliver the goods on the agreed-upon date or within the agreed-upon timeframe.

While sellers under DAP and DDP terms are only required to deliver the goods when they have arrived at the destination and are ready for unloading, sellers under DPU terms must deliver the goods after they have been unloaded from the means of transport at the destination.

Placing the goods "at the disposal of the buyer" is a principle shared with EXW and other Group D rules, where the seller must deliver the goods by placing them "at the disposal of the buyer." This means the seller must do everything necessary for the buyer to receive the goods at the delivery location without needing to do anything else. In this case, the buyer can decide what to do with the goods, such as transporting them to another location, reselling them to someone else, or storing them.

A3. Transfer of Risk

The seller bears all risks of loss or damage to the goods until the goods are delivered as per A2, except for cases of loss or damage as specified in B3.

A4. Transportation

The seller must cover the costs of contracting or arranging transport to the specified destination or place, if any, at the designated destination. If the specific location is not agreed upon or determined by practice, the seller may select the most suitable location at the destination for their purposes.

The seller must comply with any security requirements related to transportation to ensure the goods are transported to the destination.

Although under Incoterms® 2010, Group D rules specify that the seller "contracts" the transport, in Incoterms® 2020, the term is clarified to "contract or arrange" transport. Therefore, under Group D rules, the seller can use their own transport means instead of necessarily hiring third-party carriers. This provision is advantageous for Group D sellers who have their own transport means for shipment.

While in Group F, the seller only needs to meet security requirements related to transport until delivering the goods at the departure location, in Groups C and D, the seller must meet all security requirements related to transport that the seller intends to use for the transportation of goods to the specified destination or port of arrival.

A5. Insurance

The seller is not obligated to the buyer regarding the signing of an insurance contract.

As the seller under Group D assumes the risk during transportation to deliver the goods at the destination, the seller needs to procure insurance to protect their interests. Purchasing insurance is voluntary for the seller, not an obligation towards the buyer.

A6. Delivery/transport document

The seller must bear the cost of providing the buyer with any required documents for the buyer to take possession of the goods.

If sellers in Group C are required to provide transport documents for the "buyer to claim goods from the carrier," including the right to receive the goods from the carrier, sellers in Group D are only required to provide transport documents upon request so that the "buyer can receive the goods." The requirement for transport documents in Group D should be stipulated in the contract.

The general principle is that if the goods do not conform to the transport documents, buyers in Group C have the right to claim against the carrier, while buyers in Group D have the right to claim against the seller.

Furthermore, in Incoterms® 2020, the titles of Articles A6 and B6 have been unified by merging the titles of Incoterms® 2010 Articles A8 "Delivery Documents" and B8 "Evidence of Delivery" into a consistent title, "Delivery/Transport Documents."

Sellers in Groups C and D must bear the cost of providing buyers with transport documents for the buyer to obtain the goods from the carrier at the specified destination. Since the seller's obligation includes providing transport documents, Incoterms® 2010 Article A8 with the title "Delivery document" is not as suitable as the title "Delivery/Transport Documents" in Incoterms® 2020.

A7. Export/Import Customs Clearance

If necessary, the seller must handle and bear all costs related to export/transit/import customs procedures as regulated in the country of export/transit/import, including:

• Export/transit/import licenses;

• Security inspections of goods during export/transit/import;

• Pre-shipment inspections; and

• Any other formal licenses.

The customs clearance obligations of the DDP seller are broader compared to DAP and DPU in import customs procedures. Therefore, the DDP seller is not obligated, as DAP and DPU are, to provide the buyer with documents or information to complete the import customs clearance.

A8. Inspection - Packing, Marking - Checking

The seller must pay the necessary inspection costs (such as quality checks, weighing, measuring, counting) to deliver the goods as per A2.

The seller must package the goods and bear the related costs unless industry practice specifies that goods can be sent unpackaged.

The seller must pack and mark the goods according to the mode of transport, unless specific arrangements for packing and marking have been agreed upon when the contract is signed.

A9. Cost Allocation

The seller must bear:

a) All costs related to the goods and the transport of goods until they are delivered to the buyer as per A2, except those borne by the buyer under B9;

b) Unloading costs at the place of delivery, if specified in the seller's transport contract;

c) The cost of providing delivery/transport documents as per A6, indicating that the goods have been delivered;

d) Any taxes, levies, and other charges applicable to export, transit, and import customs clearance under Article A7, if any;and

e) Reimburse the buyer for all costs and charges related to assisting the seller in obtaining certificates and necessary information under B5 and B7.

Because the obligations of the DDP seller only differ from DAP in terms of import customs clearance, the expenses that the DDP seller must bear are higher than DAP in A9(d), which includes expenses related to import customs clearance such as duties and import taxes.

A10. Notification to the Buyer

The seller must inform the buyer of any necessary information to enable the buyer to take possession of the goods.

B. BUYER'S OBLIGATIONS (Buyer)

B1. General Obligations of the Buyer

The buyer must pay the purchase price as stipulated in the sales contract.

Any documents provided by the buyer can be in traditional paper form or electronic form if agreed upon by the parties or customary practice dictates.

B2. Taking Delivery

The buyer must take delivery of the goods when they have been delivered as per A2.

B3. Transfer of Risk

The buyer must bear all risks related to loss or damage to the goods from the moment the goods are delivered as per A2.

If the buyer fails to fulfill their obligations as per B7, the buyer will bear all risks and costs related to loss or damage to the goods, provided that the goods have been clearly identified as part of the contract.

If the buyer fails to notify the seller in a timely manner as per B10, the buyer will bear all risks of loss or damage to the goods from the specified date or the last day of the stipulated delivery period, provided that the goods have been clearly identified as part of the contract.

B4. Transportation

The buyer is not obligated to the seller regarding the conclusion of a transport contract.

In Groups C and D, the obligation for the transport contract belongs to the seller, so the buyer is not obliged to the seller to enter into a transport contract. If the buyer wants the goods to continue to be transported from the specified place to the final destination, the buyer may need to sign a transport contract. However, the buyer enters into this transport contract for their own benefit, so it is not an obligation of the buyer to the seller.

B5. Insurance

The buyer is not obligated to the seller to conclude an insurance contract. However, the buyer must provide the seller, upon the seller's request, with any necessary information for the seller to obtain insurance.

DDP sellers bear the risk during the journey to deliver the goods at the destination, so sellers need to purchase insurance to protect themselves from the risk of goods during transportation to the delivery location. Therefore, the seller may need information about the destination to purchase appropriate insurance. Article B5 in Group D, therefore, stipulates that the buyer must provide the seller, upon the seller's request, with the information needed to purchase suitable insurance, including the risks and costs.

B6. Delivery/transport document

The buyer must accept the transport documents provided as per A6.

B7. Customs Clearance

If necessary, the buyer must assist the seller when requested, as the seller bears the risk and costs, in obtaining the necessary information for export, transit, and import customs clearance, including any security or inspection requirements imposed by the exporting, transit, or importing country, such as:

Export/transit/import licenses;

Security checks for goods during export/transit/import;

Pre-shipment inspections; and

Any other official permits.

The customs clearance obligation under DDP differs from DAP and DPU only in import customs clearance procedures. Therefore, buyers under DAP and DPU have the obligation to clear import customs and assist the seller in export and transit customs clearance. DDP buyers have no specific customs clearance obligation but must assist the seller in obtaining the documents and information necessary for export, transit, and import customs clearance.

B8. Inspection – Packaging – Marking

The buyer has no obligations towards the seller in this regard.

B9. Cost Allocation

The buyer must:

a) Pay all costs related to the goods from the moment they are delivered as per A2;

b) Bear all necessary unloading costs at the place of delivery, unless included in the seller's transport contract; and

c) Reimburse any expenses incurred by the seller if the buyer fails to fulfill their obligations under B7 or fails to notify the seller as per B10, provided that the goods have been clearly identified as part of the contract. As DDP requires the buyer to handle import customs clearance, DDP buyers do not have to bear import-related costs like DAP and DPU. Additionally, since DPU sellers must deliver goods already unloaded, DPU buyers do not have to bear unloading costs from the transport vehicle like DAP and DDP.

The general principle is that the seller must bear all costs related to the goods and their transport until delivery, and conversely, the buyer must bear all costs from that point onwards. Therefore, all provisions in B9 stipulate that the buyer must bear all costs from the moment the seller has delivered the goods as per A2. The delivery moment is the point at which the costs shift from the seller to the buyer.

As seen in all B3 provisions, the buyer must bear the risk before the seller delivers the goods if the buyer breaches their obligations, allowing the seller to be unable to deliver on time or at the agreed-upon location. Both B3 and B9 specify conditions for transferring additional costs to the buyer, namely that the goods must be "clearly identified as part of the contract" (specific identification).

B10. Notification to the Seller

In cases where the buyer has the right to determine the delivery time and/or the destination or point of taking charge at the destination, the buyer must notify the seller promptly of these details.

If buyers in Group C and Group D have the right to determine the time or location of receiving the goods at the specified destination, they must inform the seller appropriately to enable the seller to instruct the carrier to deliver the goods at the correct time and location at the destination.

|

Advantages |

Disadvantages |

|

1. The seller is responsible for and bears the cost of transporting goods from the place of production to the destination, including import fees and completing customs procedures.

2. The seller assumes all risks and responsibilities related to the goods until they are delivered to the buyer at the destination.

3. The seller must cover all expenses associated with transporting the goods, including transportation fees, insurance, and other charges.

|

1. Because the seller is responsible for and covers the costs of most transportation and customs activities, the selling price of the goods is usually higher compared to other conditions within Incoterms.

2. Because the seller bears all the responsibilities and costs related to the goods during transportation, the seller needs to have an efficient transportation and customs management system to avoid unwanted risks and expenses during the shipment of goods. |

Therefore, using the DDP (Delivered Duty Paid) Incoterms® 2020 is suitable for certain specific business cases, such as when the goods have high value or require complex import procedures. However, sellers need to carefully calculate and assess the risks and costs to determine whether using the DDP term aligns with their business needs or not.

Above is a compilation of information to help everyone have a clearer understanding of the DDP Incoterms® 2020. In general, in commercial activities, each term clearly delineates the responsibilities of the seller and the buyer. Therefore, if there are any questions or concerns regarding import and export of goods, feel free to contact FDVN for the most comprehensive and attentive consulting support.

(1).jpg)

CONTACT US:

Lawyers in Da Nang:

99 Nguyen Huu Tho, Quan Hai Chau, Da Nang city

Lawyers in Hue:

366 Phan Chu Trinh, Hue City, Thua Thien Hue

Lawyers in Ho Chi Minh City:

No. 122 Dinh Bo Linh Street, Binh Thanh District, Ho Chi Minh City

Lawyers in Ha Noi:

Room 501, 5th Floor, No. 11, Lane No. 183, Dang Tien Dong Street, Dong Da District, Ha Noi

Lawyers in Nghe An:

No. 19 V.I Lenin street, Vinh City, Nghe An Province

Website: www.fdvn.vn www.fdvnlawfirm.vn www.diendanngheluat.vn www.tuvanphapluatdanang.com

Email: fdvnlawfirm@gmail.com luatsulecao@gmail.com

Phone: 0935 643 666 – 0906 499 446

Fanpage LUẬT SƯ FDVN: https://www.facebook.com/fdvnlawfirm/

Legal Service For Expat: https://www.facebook.com/fdvnlawfirmvietnam/

TỦ SÁCH NGHỀ LUẬT: https://www.facebook.com/SayMeNgheLuat/

DIỄN ĐÀN NGHỀ LUẬT: https://www.facebook.com/groups/saymengheluat/

Youtube: https://www.youtube.com/c/luatsufdvn

Telegram: https://t.me/luatsufdvn

Group “Legal forum for foreigners in Vietnam”: https://www.facebook.com/groups/legalforeignersinvietnam

Other Articles

- INFOGRAPHIC ĐIỀU KIỆN CẤP GIẤY PHÉP CUNG CẤP DỊCH VỤ TỔ CHỨC THỊ TRƯỜNG GIAO DỊCH TÀI SẢN MÃ HÓA / INFOGRAPHIC CONDITIONS FOR GRANTING A LICENSE FOR PROVIDING SERVICES OF OPERATING A TRADING VENUE FOR CRYPTO-ASSETS

- INFOGRAPHIC 14 ĐỐI TƯỢNG ĐƯỢC MIỄN HỌC PHÍ TRONG LĨNH VỰC GIÁO DỤC ĐÀO TẠO / INFOGRAPHIC 14 BENEFICIARIES OF TUITION FEE EXEMPTION IN THE FIELD OF EDUCATION AND TRAINING

- INFOGRAPHIC ĐIỀU KIỆN ĐỂ DOANH NGHIỆP, NGÂN HÀNG THƯƠNG MẠI ĐƯỢC CẤP GIẤY PHÉP SẢN XUẤT VÀNG MIẾNG / INFOGRAPHIC CONDITIONS FOR ENTERPRISES AND COMMERCIAL BANKS TO BE GRANTED A LICENSE FOR THE PRODUCTION OF GOLD BARS

- TỪ NGÀY 01/07/2025, NGƯỜI DÂN THỰC HIỆN THỦ TỤC ĐĂNG KÝ ĐẤT ĐAI, TÀI SẢN GẮN LIỀN VỚI ĐẤT LẦN ĐẦU ĐƯỢC LỰA CHỌN NỘP HỒ SƠ ĐẤT ĐAI TRONG CÙNG TỈNH / FROM JULY 1, 2025 INDIVIDUALS CARRYING OUT FIRST TIME REGISTRATION PROCEDURE FOR LAND AND ATTACHED ASSETS M

- KHÁCH HÀNG TRẢ THỪA TIỀN VÀ KHÔNG NHẬN LẠI THÌ CÓ PHẢI LẬP HOÁ ĐƠN GTGT ĐỐI VỚI KHOẢN TIỀN ĐÓ KHÔNG? / IF A CUSTOMER OVERPAYS AND DOES NOT REQUEST A REFUND, IS IT NECESSARY TO ISSUE A VAT INVOICE FOR THE OVERPAID AMOUNT?

- VẤN ĐỀ CẦN LƯU Ý KHI NHÀ THẦU PHỤ LÀ CÔNG TY LIÊN KẾT VỚI NHÀ THẦU / ISSUE TO NOTE WHEN THE SUBCONTRACTOR IS AN AFFILIATED COMPANY OF THE CONTRACTOR

- TỔNG HỢP 10 ĐIỂM MỚI ĐÁNG CHÚ Ý CỦA LUẬT BẢO HIỂM XÃ HỘI NĂM 2024 (CÓ HIỆU LỰC TỪ NGÀY 01/07/2025) / 10 SIGNIFICANT NEW POINTS OF THE LAW ON SOCIAL INSURANCE 2024 (TAKING EFFECT FROM JULY 1ST, 2025)

- HƯỚNG DẪN CÁCH TÍNH THUẾ TNCN TỪ CHUYỂN NHƯỢNG VỐN GÓP TRONG CÔNG TY TRÁCH NHIỆM HỮU HẠN / GUIDELINES FOR CALCULATING PERSONAL INCOME TAX ON CAPITAL CONTRIBUTION TRANSFERS IN LIMITED LIABILITY COMPANIES

- ĐỘ TUỔI VÀ CÁCH TÍNH LƯƠNG HƯU TỪ NGÀY 01/07/2025 / RETIREMENT AGE AND CALCULATION OF PENSION FROM JULY 1ST, 2025

- TRÌNH TỰ THỦ TỤC YÊU CẦU NGƯỜI LAO ĐỘNG BỒI THƯỜNG THIỆT HẠI / PROCEDURES FOR REQUESTING EMPLOYEE TO COMPENSATE FOR DAMAGES

- TỪ NGÀY 01/07/2025, CÔNG DÂN CÓ PHẢI THỰC HIỆN THỦ TỤC CẬP NHẬT LẠI ĐỊA CHỈ CƯ TRÚ SAU KHI SÁP NHẬP TỈNH VÀ XÃ, PHƯỜNG? / FROM JULY 1, 2025, ARE CITIZENS REQUIRED TO UPDATE THEIR RESIDENTIAL ADDRESS INFORMATION AFTER THE MERGER OF PROVINCES, COMMUNES, AND

- HỢP ĐỒNG THUÊ ĐẤT CÓ CẦN CÔNG CHỨNG CHỨNG THỰC KHÔNG? / IS IT REQUIRED TO NOTARIZE OR CERTIFY A LAND LEASE CONTRACT?

- 10 ĐIỂM MỚI NỔI BẬT CỦA LUẬT THUẾ GIÁ TRỊ GIA TĂNG NĂM 2024 CÓ HIỆU LỰC TỪ NGÀY 01/07/2025 / 10 NOTABLE NEW POINTS IN THE 2024 VALUE-ADDED TAX (VAT) LAW EFFECTIVE FROM 01 JULY 2025

- THỦ TỤC CHẤP THUẬN CHỦ TRƯƠNG ĐẦU TƯ: KHÔNG THỂ BỎ, NHƯNG PHẢI "ĐẠI PHẪU" ĐỂ XÓA BỎ CƠ CHẾ "XIN - CHO" / INVESTMENT POLICY APPROVAL PROCEDURE: INDISPENSABLE, BUT REQUIRING A “MAJOR SURGERY” TO ELIMINATE THE “ASK–GIVE” MECHANISM

- CORNELL NOTES FOR LEGAL VOCABS AND PHRASES: TYPES OF CLAIMS / CORNELL VỀ CỤM TỪ VÀ TỪ VỰNG PHÁP LÝ: CÁC LOẠI YÊU CẦU

- UNCITRAL COMMENTS VIETNAM LAW ON ARBITRATION