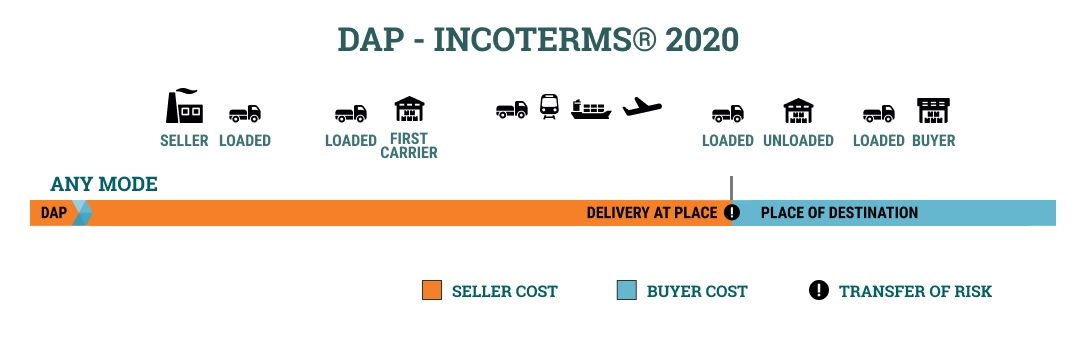

"DAP" (short for "Delivered at Place," meaning "Goods Delivered at a Specified Location") is an international trade term that specifies the respective obligations, costs, and risks related to the delivery of goods from the seller to the buyer, based on the Incoterms standards published by the International Chamber of Commerce (ICC). [1]

"Delivered at Place" (DAP) means the seller delivers the goods to the buyer when the goods are placed under the buyer's control on the transporting vehicle and are ready for unloading at the specified destination[2].

Under DAP terms, delivery at destination means that the seller delivers when the goods are placed at the buyer's disposal on the means of transport and are ready for unloading at the named place of destination. The seller bears all risks involved in bringing the goods to the specified destination. [3].

How to express DAP conditions on foreign trade contracts:

DAP [specified destination] Incoterms® 2020

For instance, if the buyer designates the delivery location at Tien Sa Port, Da Nang, with the address at 01 Yet Kieu, Tho Quang, Son Tra, Da Nang. The DAP term in this international trade contract would be expressed as follows: DAP 01 Yet Kieu, Tho Quang, Son Tra, Da Nang, Viet Nam Incoterms 2020.

II. INSTRUCTIONS FOR USE

1. Mode of transport

This condition will be applied to all modes of transportation and can be used when multiple modes of transport are involved.

2. Transfer of goods and risks

Delivery at destination means that the seller delivers the goods when they are placed at the disposal of the buyer on the arriving means of transport and ready for unloading at the specified destination. The seller bears all risks related to bringing the goods to the specified place. It is advisable for the parties to specify as precisely as possible the exact location at the specified destination.

Firstly, because the risk of loss or damage to the goods transfers to the buyer at the delivery point, it is best for both parties to specify the delivery location as precisely as possible. Secondly, the seller bears all costs to bring the goods to the delivery point, which is also the point at which the transfer of costs from the seller to the buyer occurs. Finally, this location is where the seller must arrange a transportation contract to deliver the goods. If any issues arise with the goods before they reach the delivery point, all losses will be the responsibility of the seller. For example, the seller will have to cover all types of fees that the carrier incurs during the transportation process. The seller is advised to sign a transportation contract to the exact location.

3. Unloading Costs at the Designated Place of Delivery

If the transportation contract signed by the seller includes the unloading costs at the designated place of delivery, then the seller is obliged to cover these expenses unless there was a prior agreement between both parties that the buyer will reimburse these costs to the seller.

4. Export/Import customs clearance obligations

The DAP (Delivered at Place) condition requires the seller to handle the export customs for the goods, if necessary. However, the seller is not obliged to handle import customs, pay import duties, or cover import clearance costs. If the buyer fails to clear the goods through import, the goods will be held at the port or warehouse in the importing country.

So, who bears the risk of loss or damage that may occur when the goods are held? The answer is that the buyer is responsible and bears this risk until the goods are transported to a location within the importing country's territory. From this point, the seller resumes the risk and costs associated with loss or damage of the goods until the delivery. This is clearly specified in section B3(a). If both parties believe the exporter can handle import clearance to avoid such a situation, they may consider using the DDP condition.

III. OBLIGATIONS OF BUYER AND SELLER UNDER DAP CONDITIONS

A. The Seller's obligations

A1. Seller's general obligations

The seller must provide the goods and a commercial invoice in accordance with the sales contract and supply all appropriate documents as may be required by the contract.

Any documents provided by the seller may be in traditional paper form or in electronic form if agreed upon by the parties or customary practice dictates so.

A2. Delivery

The seller must deliver the goods by placing the goods at the disposal of the buyer on the arriving means of transport ready for unloading at the agreed point, if any, at the named place of destination or by procring the goods so delivered. In wither case the seller must deliver the goods on the agreed date or within the agreed period [4].

If the seller is using Delivery at Place (DAP) or Delivered Duty Paid (DDP), they must only deliver the goods when the transportation vehicle arrives at the destination and is ready for unloading. For the Delivered at Place Unloaded (DPU) term, the seller must deliver the goods after they have been unloaded from the transporting vehicle at the destination.

Placing goods "at the disposal of the buyer"

The EXW rule and the Group D rules specify that the seller must deliver the goods by placing them "at the disposal of the buyer." This means the seller must perform all necessary actions so that the buyer, without doing anything else, can still receive the goods at the delivery point. At that time, the buyer can decide what to do with the goods for any purpose, such as transporting them to another location, reselling them to another party, storing them on-site, and so on[5],...

A3. Transfer of Risk

The seller bears all risks of loss or damage to the goods until the goods are delivered as per clause A2, except for cases of loss or damage as mentioned in clause 3.

A4. Carriage

The seller must contract or arrange ay its own cosst dor the carriage of goods to the named place of destination or agreed point, if any, at the named place of destination. If the specific point is not agreed or determined by the paracties, the seller may choose a point at the named place of destination that best suits its purpose.

The seller must comply with any transport – related security requirements for transport to the destination.

Although Incoterms® 2010, in Group D, stipulate the seller's "contract" for transportation, the seller can still arrange transportation using their own means[6]. This was made clearer in Incoterms® 2020 when changing the phrase "contract" to "contract or arrange" transportation. Hence, according to Group D rules, the seller can use their own means of transportation rather than necessarily hiring a third-party carrier. This provision is advantageous for Group D sellers, particularly businesses that have their transportation means available for shipment.

In Group F, the seller only needs to meet the security requirements related to transportation until the delivery at the departure location. However, in Groups C and D, the seller must meet all the security requirements related to transportation that the seller intends to use to transport goods to the agreed-upon destination or port [7].

A5. Insurance

The seller has no obligation to the buyer to make a contract of insurance

As the seller in Group D is responsible for risks during transportation for delivery at the agreed-upon place, the seller needs to procure insurance to safeguard their interests. The procurement of such insurance is voluntary on the part of the seller and is not an obligation, thus not mandatory for the seller towards the buyer .[8]

A6. Delivery/transport documents

The seller must provide the buyer, at the seller’s cosst, with any document required to anable the buyer to take the goods.

If a seller in Group C must provide transport documents for "the buyer to claim against the carrier for the goods," including the right to receive the goods from the carrier, a seller in Group D only needs to provide transport documents as required for "the buyer to receive the goods." Requirements for transport documents in Group D should be specified in the contract by the buyer.

Generally, if the goods do not conform to the transport document, a buyer in Group C has the right to claim against the carrier, whereas a buyer in Group D has the right to claim against the seller. [9]

Furthermore, the titles of Articles A6 and B6 in Incoterms® 2020 have merged the two titles from Articles A8 "Delivery document" and B8 "Evidence of delivery" in Incoterms® 2010 into a unified title as "Delivery/Transport documents."

Sellers in Groups C and D must bear the cost of providing the buyer with transport documents for the buyer to receive the goods from the carrier at the agreed-upon destination. Since the seller's obligation is to provide transport documents, the title "Delivery document" in Article A8 of Incoterms® 2010 doesn't align with the title " Delivery/Transport documents " in Article A6 of Incoterms® 2020. [10]

A7. Export/Import Clearance

a) Regarding export transit clearance

Where applicable, the seller must carry out and pay for all export transit clearance, formalities required by the country of export and any country of transit (other than the country of import). Such as:

• Export/transit license;

• Security clearance for export/transit;

• Pre-shipment inspections; and

• Any other official authorisation.

b) Assistance with import clearance

Where applicable, the seller must assist the buyer at the buyer’s request risk and cost in obtaining any documents and/or information related to all import clearance formilities including security requirement and pre – shipment inspection, needed by the country of import.

The seller in DAP (Delivered at Place) is responsible for and covers the costs of export and transit procedures through any country (not the importing country) as required. If the buyer requests, the seller must also assist the buyer in obtaining documents and information related to import customs procedures, with the risk and expenses borne by the buyer.[11]

A8. Checking/packaging/marking

The seller must pay the costs of those checking operations (such as checking quality, weighing, measuring, and counting) that are necessary for the purpose of delivering the goods accordance with A2.

The seller must, at its own cost, package the goods and unless it is usual for the particular trade to transport the type of goods sold unpackaged. The seller must package and mark the goods appropriately for their transport, unless parties have agreed on specific packaging or making requirements.

A9. Allocation of costs

The seller must pay for:

a) All expenses related to the goods and their transport until they have been delivered in accordance with A2, other than those payable by the buyer under B9;

b) The cost of providing evidence to the buyer as per section A6 that the goods have been delivered;

c) Expenses for necessary customs procedures for export/transit, if applicable, export taxes, and any other fees related to export/transit as in section A7(a);

d) The buyer for all costs and charges related to providing assistance in obtaining documents and information in accordance with B5 an B7 (a);

e) Any charges for unloading the goods at the place of destination but only if those charges were for the seller’s account under the contract of carriage;

Although section A9(a) in the DAP and DPU rules specifies the same conditions, due to the differences in Article A2 (Delivery) in these two rules, the cost that the seller bears in DPU is different from DAP, specifically only the unloading costs at the place of arrival.

Because the obligations of the seller in DDP differ only in terms of import customs clearance from DAP, the costs that the seller in DDP must bear are therefore higher than those in DAP in section A9(d), covering expenses related to import customs clearance, such as taxes and import duties. [12]

A10. Notice to Buyer

The seller must give the buyer any notice required to enable the buyer to receive the goods.

B. The buyer’s obligations

B1. Buyer's General Obligations

The buyer must pay the price of the goods as provided in the sales contract.

Any documents provided by the buyer can be in traditional paper form or in electronic format if agreed upon by the parties or as customary practice dictates.

B2. Taking delivery

The buyer must take delivery of the goods when they have been delivered under A2

B3. Transfer of risks

The buyer bears all risks of loss of or damage to the goods from the time they have been delivered under A2.

If the buyer fails to fulfil its obligations in accordance with B7, then it bears all resulting risks of loss of or damage to the goods, provided that the goods have been clearly identified as the contract goods.

If the buyer fails to give notice in acccordance with B10 then it bears all risks of loss of or damage to the goods from the agreed date or the end of agreed period for delivery, provided that the goods have been clearly identified as the contract goods.

B4. Carriage

The buyer has no obligation to the seller to make a contract of cariage

In accordance with Groups C and D, the responsibility for the carriage contract belongs to the seller, so the buyer is not obligated to enter into the carriage contract with the seller. If the buyer wishes the goods to continue being transported from the specified place to a different final destination, they may need to sign a carriage contract. However, when the buyer signs this carriage contract, it serves their own interests; therefore, it is not an obligation of the buyer towards the seller[13].

B5. Insurance

The buyer has no obligation to the seller to make a contract of insurance. However, the buyer must provide the seller at the seller’s request, risk and cost, with information that the seller need for obtaining insurance.

The seller in Group D must bear the risk during the journey to deliver the goods at the destination, so the seller needs to purchase insurance to protect themselves regarding the goods during the transportation to the delivery location. Therefore, the seller may need information about the destination to acquire suitable insurance. Article B5 in Group D thus stipulates that the buyer must provide, upon the seller's request, the risk and expenses, as well as the information required by the seller to obtain appropriate insurance[14].

B6. Delivery/transport document

The buyer must accept the transportation documents provided under A6.

The buyer only has to accept the documents provided when they meet the requirements outlined in A6. If the seller provides documents that do not meet the requirements of Clause A6, the buyer has the right to refuse. [15]

B7. Export/import clearance

a) Assistance with export and transit clearance

Where applicable, the buyer must assist the seller at the seller's request, risk and costs, in obtaining any documents/information related to all export/transit clearance formailties, including security requirements and pre-shipment inspection, needed by the country of export/transit.

b) Import clearance

Where applicable, the buyer must carry out and pay for all formalities required by the country of import, such as:

- Import licenses;

- Security clearance for imports;

- pre shipment inspection; and

- Any other official authorisation.

B8. Checking/packaging/marking

The buyer has no obligation to the seller

B9. Allocation of costs:

Buyer must pay:

a) All costs relating to the goods from the time they have been delivered under A2;

b) All costs of unloading necessary to take delivery of the goods from arriving means of transport at the named place of destination, unless such costs were for the seller;s account under the contract of carriage;

c) The seller for all costs and charger related to providing assistance in obtaining documents and information in accordance with A7(b);

d) where applicable, duties, taxes and other costs related to import under B7(b);

e) any additiona cost incurred by the seller if the buyer fail o fulfil its obligation in accordance with B7 or to give otice in accordance with B10, provided that the goods have been clearly identified as contract goods.

B10. Notice to the seller

If the buyer has the right to determine the time within the agreed period and/or the place of receiving the goods at the designated destination, the buyer must inform the seller appropriately.

If the buyer in group C and group D has the right to decide on the time or place of receiving the goods at the specified destination, the buyer must inform the seller adequately so that the seller can promptly instruct the carrier to deliver the goods at the correct time and place at the destination[16].

Here are the advantages and disadvantages of the DAP condition:

|

Advantage |

Disadvantage |

|

1. The seller is responsible for and covers the cost of transporting goods to the designated destination, helping the buyer save costs and time in the transportation of goods.

2. Export procedures and transportation to the destination are managed and controlled by the seller, reducing responsibilities and workload for the buyer.

3. DAP helps parties in the transaction save time and costs as the transportation of goods is ensured to the destination. |

1. The buyer must bear the responsibility and costs associated with importing goods into the destination country, including taxes and import-related fees.

2. The buyer may encounter difficulties in handling customs procedures and those related to transporting goods to the destination.

3. Managing and resolving risks during the transportation process from the seller to the destination fall under the responsibility of the buyer. |

Therefore, when using the DAP Incoterm rule, the buyer needs to have knowledge and experience in managing transportation and import procedures. Simultaneously, it's essential to ensure that the seller utilizes reputable transportation services, guaranteeing safe and timely delivery. Furthermore, all parties should also pay attention to factors such as costs and responsibilities during the transportation process.

The above is a summary of the information that helps people understand more about the DAP Incoterm 2020. In general, in commercial activities, each condition clearly demonstrates the responsibilities of the seller and the buyer. Therefore, if there are any questions or concerns that need advice on importing and exporting goods, feel free to contact FDVN for further assistance.

[1] https://phaata.com/thi-truong-logistics/dap-la-gi-901.html

[2] To Binh Minh, Incoterms 2020 Explanation and instructions for use (2020) Page 39

[3] https://phaata.com/thi-truong-logistics/dap-la-gi-901.html

[4] To Binh Minh, Incoterms 2020 Explanation and instructions for use (2020) Page 66

[5] To Binh Minh, Incoterms 2020 Explanation and instructions for use (2020) Page 67

[6] ICC, Questions and expert ICC guidance on the Incoterms ® 2010 rules, 2013

[7] To Binh Minh, Incoterms 2020 Explanation and instructions for use (2020) Page 81

[8] To Binh Minh, Incoterms 2020 Explanation and instructions for use (2020) Page 87

[9] To Binh Minh, Incoterms 2020 Explanation and instructions for use (2020) Page 95

[10] To Binh Minh, Incoterms 2020 Explanation and instructions for use (2020) Page 91

[11] To Binh Minh, Incoterms 2020 Explanation and instructions for use (2020) Page 100

[12] To Binh Minh, Incoterms 2020 Explanation and instructions for use (2020) Page 114

[13] To Binh Minh, Incoterms 2020 Explanation and instructions for use (2020) Page 83

[14] To Binh Minh, Incoterms 2020 Explanation and instructions for use (2020) Page 89

[15] To Binh Minh, Incoterms 2020 Explanation and instructions for use (2020) Page 97

[16] To Binh Minh, Incoterms 2020 Explanation and instructions for use (2020) Page 127

Read more:

SOME THINGS YOU MAY NOT KNOW ABOUT FOB IN INCOTERMS 2020

EXW CONDITIONS IN INCOTERM 2020 - THINGS YOU MAY NOT KNOW

WHAT ARE INCOTERMS? - THE HISTORY OF THE FORMATION OF INCOTERMS® RULES

(1).jpg)

CONTACT US:

Lawyers in Da Nang:

99 Nguyen Huu Tho, Quan Hai Chau, Da Nang city

Lawyers in Hue:

366 Phan Chu Trinh, Hue City, Thua Thien Hue

Lawyers in Ho Chi Minh City:

No. 122 Dinh Bo Linh Street, Binh Thanh District, Ho Chi Minh City

Lawyers in Ha Noi:

Room 501, 5th Floor, No. 11, Lane No. 183, Dang Tien Dong Street, Dong Da District, Ha Noi

Lawyers in Nghe An:

No. 19 V.I Lenin street, Vinh City, Nghe An Province

Website: www.fdvn.vn www.fdvnlawfirm.vn www.diendanngheluat.vn www.tuvanphapluatdanang.com

Email: fdvnlawfirm@gmail.com luatsulecao@gmail.com

Phone: 0935 643 666 – 0906 499 446

Fanpage LUẬT SƯ FDVN: https://www.facebook.com/fdvnlawfirm/

Legal Service For Expat: https://www.facebook.com/fdvnlawfirmvietnam/

TỦ SÁCH NGHỀ LUẬT: https://www.facebook.com/SayMeNgheLuat/

DIỄN ĐÀN NGHỀ LUẬT: https://www.facebook.com/groups/saymengheluat/

Youtube: https://www.youtube.com/c/luatsufdvn

Telegram: https://t.me/luatsufdvn

Group “Legal forum for foreigners in Vietnam”: https://www.facebook.com/groups/legalforeignersinvietnam

Other Articles

- INFOGRAPHIC 06 TRANH CHẤP LAO ĐỘNG ĐƯỢC KIỆN THẲNG RA TÒA ÁN MÀ KHÔNG PHẢI THÔNG QUA THỦ TỤC HÒA GIẢI / INFOGRAPHIC 06 LABOR DISPUTES THAT MAY BE FILED DIRECTLY WITH THE COURT WITHOUT UNDERGOING MEDIATION PROCEDURES

- MỨC LƯƠNG TỐI THIỂU VÙNG THEO NGHỊ ĐỊNH 293/2025/NĐ-CP (có hiệu lực từ ngày 01/01/2026) / REGIONAL MINIMUM WAGE LEVELS UNDER DECREE NO. 293/2025/NĐ-CP (Effective from January 1, 2026)

- INFOGRAPHIC CÁC NGÀNH NGHỀ, LĨNH VỰC ĐƯỢC HƯỞNG CHÍNH SÁCH KHUYẾN CÔNG TỪ NGÀY 15/10/2025 / INFOGRAPHIC BUSINESS LINES AND SECTORS ELIGIBLE FOR INDUSTRIAL ENCOURAGEMENT POLICIES FROM OCTOBER 15, 2025

- INFOGRAPHIC ĐIỀU KIỆN THU GIỮ TÀI SẢN BẢO ĐẢM CỦA NGÂN HÀNG TỪ NGÀY 15/10/2025 / INFOGRAPHIC CONDITIONS FOR SEIZE COLLATERAL OF SECURED ASSETS BY BANKS EFFECTIVE FROM OCTOBER 15, 2025

- HƯỚNG DẪN CÁCH TÍNH TIỀN NỘP BỔ SUNG KHI GIA HẠN DỰ ÁN / GUIDANCE ON THE CALCULATION OF ADDITIONAL PAYMENTS UPON PROJECT EXTENSION

- HƯỚNG DẪN VỀ ĐỊNH GIÁ ĐẤT THEO PHƯƠNG PHÁP THU NHẬP / GUIDANCE ON LAND VALUATION USING THE INCOME-BASED METHOD

- QUYẾT ĐỊNH SỐ 36/2025/QĐ-TTg BAN HÀNG HỆ THỐNG NGÀNH KINH TẾ VIỆT NAM

- NHÌN TỪ DỰ THẢO BẢNG GIÁ ĐẤT 2026 Ở HÀ NỘI: “CHI PHÍ ĐẦU VÀO TĂNG, LÀM SAO GIẢM ĐƯỢC GIÁ NHÀ?” / FROM THE DRAFT OF HANOI’S LAND PRICE TABLE IN 2026: “WITH INPUT COSTS RISING, HOW CAN HOUSING PRICES BE REDUCED?”

- QUY ĐỊNH PHÁP LUẬT VÀ THỰC TIỄN ÁP DỤNG BIỆN PHÁP PHONG TỎA TÀI SẢN TRONG TỐ TỤNG DÂN SỰ / LEGAL PROVISIONS AND PRACTICAL APPLICATION OF THE MEASURE OF ASSET FREEZING IN CIVIL PROCEEDINGS

- NHÀ ĐẦU TƯ NƯỚC NGOÀI THỰC HIỆN HOẠT ĐỘNG ĐẦU TƯ GIÁN TIẾP NƯỚC NGOÀI TẠI VIỆT NAM ĐƯỢC MỞ VÀ SỬ DỤNG TÀI KHOẢN ĐẦU TƯ GIÁN TIẾP TỪ NGÀY 16/6/2025 / FOREIGN INVESTORS ENGAGING IN INDIRECT FOREIGN INVESTMENT IN VIETNAM SHALL BE ENTITLED TO OPEN AND UTILISE

- REFORM OF INHERITANCE REGULATIONS TO ENSURE THE DEVELOPMENT OF THE PRIVATE ECONOMY / CẢI CÁCH CHẾ ĐỊNH THỪA KẾ NHẰM BẢO ĐẢM PHÁT TRIỂN KINH TẾ TƯ NHÂN

- TỔNG HỢP CÁC MẪU HỢP ĐỒNG THUÊ NHÀ CỦA 11 QUỐC GIA / COLLECTION OF RESIDENTIAL TENANCY AGREEMENT TEMPLATES FROM 11 COUNTRIES

- CÔNG VĂN SỐ 13629/BTC-DNTN CỦA BỘ TÀI CHÍNH VỀ VIỆC TRẢ LỜI CÁC ĐỀ XUẤT LIÊN QUAN ĐẾN CÁC KHÓ KHĂN, VƯỚNG MẮC DO QUY ĐỊNH PHÁP LUẬT TRONG LĨNH VỰC TÀI CHÍNH, ĐẦU TƯ

- TỔNG HỢP LUẬT GIAO DỊCH ĐIỆN TỬ CỦA MỘT SỐ QUỐC GIA TRÊN THẾ GIỚI / COLLECTION OF LAW ON ELECTRONIC TRANSACTIONS OF SOME COUNTRIES IN THE WORLD

- TỔNG HỢP MỘT SỐ MẪU HỢP ĐỒNG DO CHÍNH PHỦ VƯỚNG QUỐC ANH BAN HÀNH / COLLECTION OF SOME CONTRACT BOILERPLATES ISSUED BY THE UNITED KINGDOM’S GOVERNMENT

- TUYỂN TẬP LUẬT XÂY DỰNG CỦA 10 QUỐC GIA TRÊN THẾ GIỚI / COLLECTION OF CONSTRUCTION LAW OF 10 COUNTRIES IN THE WORLD

-4113.jpg)

-0847.jpg)